- Supported the venture from the product validation stage by connecting with industry experts

- Helped to tie up with Spice Jet for last mile Covid-19 vaccine deliveries

- Scaled up from INR30lacs GMV p.m. to currently over INR38rs GMV p.m.

- Helped to tie up with Shriram Transport Finance for refer vehicle financing, first time for STF

How we partner

Eaglewings Uprise

Bespoke Venture Building Program

By associating as financial co-founders, we are fully committed to helping entrepreneurs achieve success as we take a long-term approach to partnership. We believe in working closely with our portfolio companies from the very beginning, by providing them with the guidance and support they need to create a solid foundation for growth.

Our core activities are:

- Sharpening the value proposition

- Identification and planning of revenue streams

- Preparation of financial model and projections

- Deal structuring and fund raise

- Due diligence support

- MIS – post funding

- Internal audit – post funding

- Strategic HR support – post funding

Eaglewings Rise Fund

CAT 1 VC Angel Fund

A SEBI registered Angel Fund to back our venture building program.

Through this funding vehicle, we aim to invest in our venture building portfolio

companies as well co-invest in other promising startups along with reputed VCs,

HNIs, family offices, Networks etc.

- Total fund size – INR100crs

- Per deal investment – INR25lacs-INR4crs

- Stages - Pre-seed, Seed, Post Seed, Pre-Series A

- Sector - Agnostic

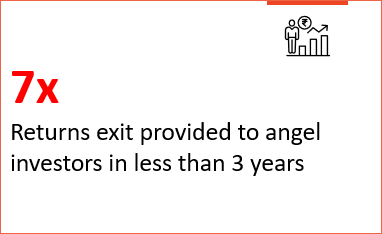

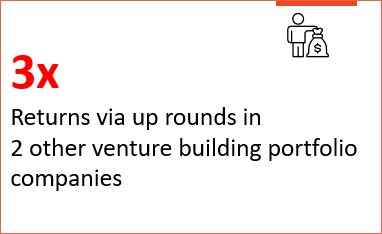

Our venture building and investments model ensures risk mitigation from very early stages so that investor’s investments remain safe.